Do you know that over 71% of global users prefer digital financial services over traditional banking services? And as a result of increased trust in mobile-first finance, businesses are racing to launch scalable FinTech solutions that exceed user expectations. However, before you step into this high-growth market, it is crucial to have a clear answer to the question, “How much does it cost to build a FinTech app?”

Well, there is no single fixed answer to this question. It is because the FinTech app development cost can vary, depending on different factors like the project’s scope, complexity, features, and others. But, on average, the cost to build a financial app can range from $20,000 to $250,000+, and it can increase if you integrate more advanced features.

And on that note, continue reading our FinTech app development guide to have a closer look at these factors, development stages, features, and how to budget smartly.

FinTech Industry Overview

Here are some statistics that companies should consider before investing in FinTech application development services:

- The FinTech sector is projected to hit USD 394.88 billion by the end of 2025.

- By 2032, the digital finance market is expected to reach USD 1,126.64 billion.

- Currently, there are over 4.5 billion global users of digital wallets, and this number is increasing every day.

This massive adoption and industry growth enables business owners to establish their brand loyalty and capture a significant market share. Also, you can future-proof your business by crafting a robust and secure financial app. However, before that, it’s crucial to calculate the cost of developing a FinTech app and associated features.

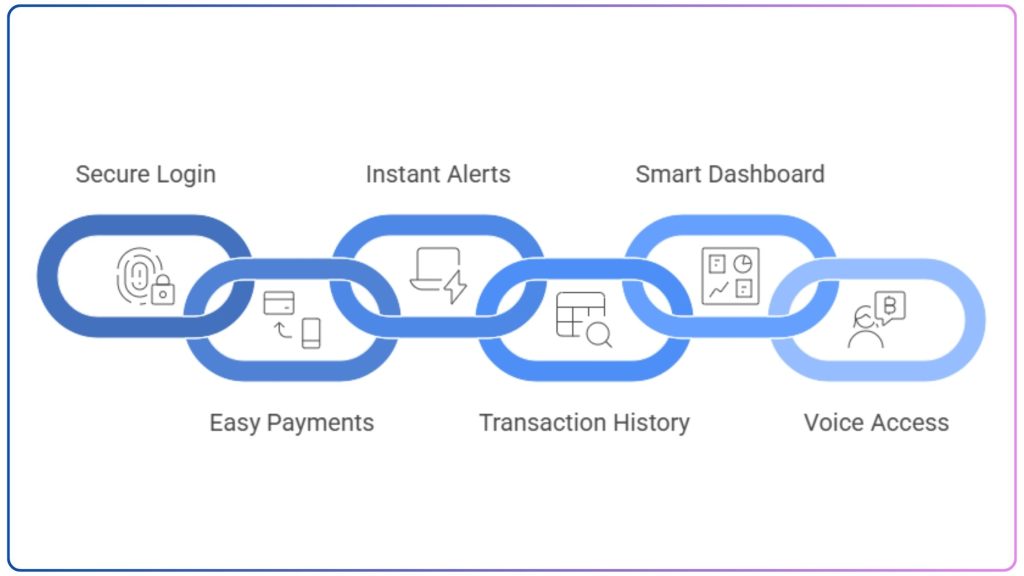

Must-Have Features for FinTech App Development

To understand the exact fintech app development cost, it is vital to have an idea of the essential features that make it successful. So, take a look at these:

1. User Registration & Secure Authentication

End users want a smooth onboarding process with a strong authentication method like OTP or biometrics. In the end, this preserves sensitive financial information and fosters user trust.

2. Payment Gateway Integration

To make your financial apps fast and secure, it is vital to smoothly integrate third-party services or APIs like PayPal or Stripe.

3. Push Notifications & Alerts

Users want timely updates to manage their account activities, so prevent unauthorized transactions by offering alerts when payments, withdrawals, daily limits, promotions, and suspicious behaviours occur.

4. Transaction Management & History

Users expect complete visibility into their financial activity. Clear transaction records, categories, downloadable statements, and smart filters enhance transparency and user control.

5. Dashboards

A clean, intuitive dashboard that displays balances, transactions, spending patterns, investments, or policy details delivers immediate value and keeps users engaged with their financial activities.

6. Voice-Integration

By incorporating a voice assistant into your FinTech app development, you can offer a hands-free banking experience to users. This ultimately enables them to access accounts, make transactions, and get financial insights through voice instructions.

Types of FinTech Apps and Their Average Cost

Not all FinTech apps are the same, hence each one requires different investment. Below is a breakdown of the most common FinTech app types along with their estimated cost.

| App Type | Features | Cost |

| Mobile Banking Apps | Account management, fund transfers, and card controls | $18,000 – $35,000+ |

| Digital Wallets | Robust security, KYC/AML compliance | $50,000 – $80,000+ |

| Investment & Wealth Management Apps | Portfolio tracking, market insights | $150,000–$185,000+ |

| Lending & Loan Management | Credit scoring modules, EMI calculators, loan applications, and automated approval workflows | $70,000 – $100,000+ |

| Insurance (InsurTech) Apps | Policy management, claims processing, risk scoring, and chat-based support. | $80,000–$180,000+ |

| Cryptocurrency & Blockchain Apps | Trading platforms and blockchain-based FinTech systems | $90,000 – $250,000+ |

Factors Influencing FinTech App Development Cost

Here are the factors that have a huge impact on FinTech mobile app development cost:

1.Complexity of App

The more complex your FinTech app is, the higher the development cost.

| App Complexity | Features Included | Cost Involved |

| Simple | Basic registration, user authentication, and profile management | $20K–$70K |

| Medium | Analytics dashboards, integrating payment gateways and custom UI | $50K–$130K |

| Complex | Advanced security features | $120K – $250,000+ |

2.Platform Choice

Regardless of whether you choose iOS, Android, or both, your platform strategy influences the cost. Building separate apps for both platforms will take more resources and effort, resulting in higher costs. On the other hand, choosing cross-platform app development will be cost-effective as developers can use a single codebase for building apps that work on both platforms. Below is a brief breakdown:

| Type | Cost | Reason |

| Native Apps | $20,000 to $75,000 (for a single platform, either iOS or Android) | Building an app for a single platform is beneficial than creating a separate app for both. |

| Cross-Platform | $35,000 to $85,000(for multiple platforms) | Creating a cross-platform app can be cost-effective as a single codebase serves multiple platforms which results in lower upfront cost. |

3.Chosen Tech Stack

Your FinTech app’s performance is influenced by your technology stack. High-security backend frameworks, cloud-based infrastructures, and advanced data processing tools may increase upfront costs but deliver better stability, compliance, and future expansion capabilities—critical for any FinTech product.

4.UI/UX Design

The initial impression left by the FinTech app ultimately determines how successful the application will ultimately be. And a well-researched UI/UX design of a FinTech app includes user flows, wireframes, prototypes and other forms of access to the application and will increase the total FinTech app development cost. However, visually appealing and engaging applications significantly improve customer experience, user engagement and ultimately, retention levels. Average pricing for a FinTech app design based on templates typically ranges between $5000 to $10,000, while custom FinTech app designs will cost somewhere between $25,000 and $40,000. FinTech apps designed using advanced techniques or with animations will cost you $50,000 or higher.

5.Third-Party Integrations

Financial apps often rely on multiple APIs like payment gateways, banking APIs, analytics, and cloud services. And each of these integration enhances the complexity level, increasing development cost and effort along the way.

6.Development Team

Hiring freelancers or outsourcing FinTech application development services can also influence the final budget. While freelancers may have lower rates, they may lack the necessary resources and skills. On the flip side, a reliable FinTech app development company provides end-to-end services to build a fully compliant product, though at a higher cost.

7.Post-Launch Support

You need to maintain your app after it has been launched to continuously provide a secure experience to end users. Therefore, an ongoing maintenance schedule (i.e., regular updates, security patches, compliance upgrades, performance monitoring, and new feature releases) is necessary for keeping your application in line with industry standards. Because of this, it is advisable to set aside approximately 15-20% of your overall development budget for ongoing maintenance.

Cost Breakdown by Factors—A Quick Overview

| Factor | Estimated Cost |

| Tech Stack | $5,000 – $100,000+ |

| Complexity | $50,000 – $450,000+ |

| Platform Choice | $10,000 – $85,000+ |

| UI/UX | $5,000 – $50,000+ |

| Development Team | $25–$250/hr |

| Post-Launch Support | $15,000–$20,000 (annually) |

| API Integration | $5,000 – $55,000 |

Step-By-Step FinTech App Development Guide

When developing a Unique and Effective FinTech product, strategic Planning Process and well-structured plan is essential. The following section offers a practical end-to-end roadmap to minimize FinTech app development cost while providing for a Secure and Scalable Product.

1.Research Analysis

Start the process by understanding your target audience, market trends, and competitive landscape. This way, you can identify user expectations, compliance requirements, and technical challenges early on.

2.Set a Budget

Having a clear budget is essential. And to establish a realistic budget, define must-have features, the preferred tech stack, and compliance needs. So, businesses can allocate funds effectively across design, development, security and testing.

3.Hire a Reliable Development Team

Here, you can choose to hire an inhouse team, freelancers or comprehensive FinTech application development services from a dedicated agency. Ultimately, the right team will help accelerate delivery, reduce cost and offer end-to-end expertise.

4.MVP Development

It is better to launch a Minimum Viable Product consisting of core functionalities essential to your value proposition. This keeps your budget in check, speeds up launch timelines, and helps validate your idea with real users before scaling it into a full-featured FinTech solution.

5.Testing and Deployment

Once the MVP is ready, conduct functional testing, security testing, performance testing, and compliance checks to make sure it works as expected. Verify all the regulatory requirements and deploy it on the chosen platform (Apple Store or Google Play Store) with proper monitoring tools.

6.Ongoing Support

When you engage trusted FinTech application development services, they offer regular maintenance and support services and keep an eye on your FinTech solution. With the regular feature updates, security patches, audit readiness, and system optimization, they ensure your FinTech app remains robust, compliant, and competitive.

FinTech App Development Cost Based on Developer’s Location

The location of your development team is also a major factor contributing to the overall FinTech app development cost. It is because every country has a different cost of living, which impacts the hourly development rates. Below is a brief cost comparison for engaging FinTech application development services based on location:

| Location of Developers | Hourly Rates |

| North America (USA/Canada) | $120–$250+ |

| Western Europe (UK/Germany) | $80–$180 |

| Eastern Europe (Poland/Ukraine) | $45–$85 |

| Asia (India/Vietnam) | $25–$50 |

| Latin America (Brazil/Argentina) | $40–$75 |

Remember, the location should not be the only factor weighing in your decision. You need to evaluate the team’s experience, skills, knowledge of the FinTech industry, and communication strategy to make the right choice.

Hidden Cost To Develop a FinTech App

FinTech app development cost is not just about designing and coding. Rather, there are multiple factors, like licensing fees, that businesses often overlook. However, in reality, these cannot be ignored.

Below is a list of hidden elements that increase your overall development budget.

| Factor | Why It Matters |

| Licensing and Compliance Fees | Your FinTech app must be compliant with regulations like KYC, AML, PCI-DSS, and GDPR. This adds incremental costs, which are essential for legal and secure operations. |

| Third-Party API and Service Charges | Integrations for payments, banking APIs, identity verification, credit scoring, or cloud services often include recurring subscription or transaction-based fees that directly impact long-term operating costs. |

| Feature Enhancement | If you add advanced features, the cost will go higher as a result |

| Advanced Security Measures | Encryption layers, threat monitoring, and fraud detection systems, they require dedicated investment beyond core development |

| Continuous Maintenance and Upgrades | Regular updates and bug fixes can increase operational costs |

Top Ways to Reduce FinTech App Development Cost

Business owners and developers can manage FinTech app development costs without compromising quality but with a strategic approach. By focusing on high-impact elements and making smart engineering decisions, businesses can build a secure, scalable, and competitive product while keeping budgets under control.

1.Prioritize Essential Features

Start by clearly defining your core value proposition and focus on the features that directly solve your users’ biggest pain points. So, by simplifying the functionalities of your app, you can lower the fintech app development cost, as it takes less effort.

2.Start With MVP

A futuristic MVP development company can help you test and validate your app vision in the market while getting constructive feedback from users. This approach prevents overspending on features that may not be necessary and accelerates time-to-market.

3.Outsource Right FinTech App Development Services

Working with an experienced FinTech application development services provider can significantly reduce costs while ensuring top-tier quality. The right partner brings industry expertise, security-first engineering, and efficient processes. This ultimately eliminates trial-and-error development and long-term risks.

4.Use Open-Source Tools and Technologies

Leveraging open-source libraries, frameworks, and security tools can cut down licensing fees and speed up development. When implemented properly, they offer enterprise-level performance without compromising reliability or compliance.

5.Go Cloud-Native

Adopting cloud-based solutions can reduce existing costs associated with purchasing, operating and maintaining hardware, while allowing easier scaling as needed. These cloud-native offerings also provide a high level of security and automated upgrading which aid FinTech companies in managing their long-term maintenance costs through cloud infrastructure as well as protecting customer and business data.

6.Adopt Agile Development Methodology

The agile process ensures faster iterations, clear communication, and early rectification of issues. By breaking development into manageable sprints, teams avoid expensive rework and deliver a more polished product in less time.

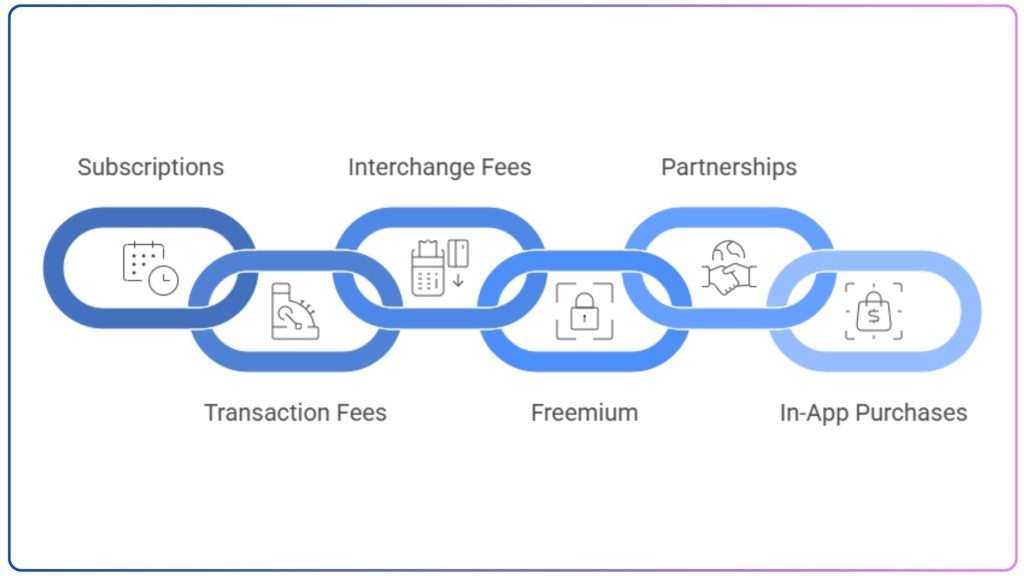

Monetization Strategies For Your FinTech App

A well-defined revenue model is a critical component of your initial business plan and directly impacts your overall fintech app development cost. Hence, choosing the right strategy ensures long-term sustainability and scalability. So, this section of our comprehensive fintech app development guide explores the proven methods for commercializing your financial technology platform.

1.Subscription Model

You can get predictable revenue by charging a recurring fee (monthly or yearly) to access features. It also encourages customer retention by delivering ongoing value that justifies the subscription cost.

2.Transaction Fees

Businesses can earn by charging a small commission or fee on successful transactions. This approach works well for peer-to-peer transfers and trading platforms.

3.Interchange Fees

This model is critical for digital banking or digital wallet apps that issue physical or virtual debit/credit cards. Your FinTech app earns a small percentage fee charged to the merchant whenever a user makes a purchase using the app’s associated card.

4.Freemium Features

The freemium model offers basic, essential services for free to drive massive user adoption, while reserving advanced or specialized functionalities for paying users. This monetization strategy acts as a powerful acquisition funnel and enables users to experience the product’s value before committing capital.

5.Partnerships and Sponsorships

Collaborating with banks, insurance companies, or investment firms can open new sources of revenue. Businesses can generate referral income or commission fees without disrupting the core user experience.

6.In-App Purchase

Beyond standard subscriptions, this model allows for the one-time sale of non-consumable, high-value digital goods or services. You can capture revenue from users who are reluctant to commit to a recurring subscription but are willing to pay a premium for specific and high-quality features.

Why Choosing CodingWorkX as Your FinTech Application Development Services Partner Is Beneficial

We at CodingWorkX are a leading FinTech app development company with deep knowledge and expertise in building robust and intuitive financial apps that are compliant with regulatory requirements. Our experts understand the changing landscape, user expectations, and rapid technological innovation.

We are there to assist you at every step, from strategy to development to long-term support with our comprehensive services. We help you build FinTech apps that earn user trust and drive measurable business growth. So, if you are thinking of creating a powerful FinTech application, contact us today and get expert guidance for your next project.

Conclusion

Well, there is no fixed answer to the question, “How much does it cost to build a FinTech app? ” And as discussed above, the FinTech app development cost is variable; depending on multiple elements, the initial investment can range from $20K to $250,000 for a fully-fledged and complex app. To get a detailed estimation, it’s better to consult with a leading Fintech application development services provider. They will offer strategic guidance, along with building a secure and compliant FinTech product. So, stop guessing and take the right step to turn your FinTech app vision into a reality.

FAQs

How much does it cost to build a FinTech app?

It is quite difficult to give an accurate price for FinTech app development, as it depends on numerous factors like features, complexity, and compliance needs. However, the budget can increase if you integrate advanced features like AI automation, multi-platform support, and others.

How long does it take to develop a financial app?

It will take about 3 to 6 months to build a Minimum Viable Product (MVP) version of your financial app. But to craft a fully-fledged FinTech app will take up to 12 months.

What factors influence the FinTech app development cost?

The cost to develop a FinTech app depends on multiple factors, like the project’s scope, complexity, feature list, UI/UX depth, security protocols, third-party integrations, and many more.

How do I choose the best FinTech application development services?

Look for a team with proven FinTech expertise, strong security practices, and end-to-end product capabilities. Evaluate their portfolio, regulatory understanding, and technology approach to ensure your product scales confidently and securely.