Every billion-dollar startup begins the same way – with an idea scribbled on a napkin, a few lines of code in a dimly lit room, or a moment of frustration that sparks a solution.

You’ve probably heard stories of scrappy founders turning apps into unicorns, raising millions in funding, and ringing the opening bell at the New York Stock Exchange. But what most people don’t see is the winding, uphill climb it takes to get there – the all-nighters, the pivots, the rejections, the moments of doubt… and the sheer will to keep going.

This isn’t just another article about startups.

This is the app development journey – raw, real, and unfiltered – from that lightbulb moment to launching your app, scaling it into a business, surviving investor meetings, and finally, going public.

Whether you’re at the idea stage or deep in development, this guide will walk you through the milestones, mindset shifts, and practical decisions every app-based entrepreneur must make on the road from idea to IPO app.

Because building an app is easy. Building a company that lasts? That’s the real story.

Validating Your App Idea (Before You Write a Line of Code)

Before you spend a penny on development or lose sleep over UI animations, pause, and validate your idea. Because here’s the truth no one likes to hear: a brilliant idea doesn’t guarantee a successful app.

Too many entrepreneurs fall in love with their solution before truly understanding the problem. The result? Months of work and thousands of dollars sunk into an app startup lifecycle building something no one actually wants.

So how do you validate your app idea without writing a single line of code?

1. Start With the Problem, Not the Product

Ask yourself: What exact problem does this solve? Who’s facing it? How are they solving it now?

If you can’t clearly articulate the problem and your edge over existing alternatives, you’re not ready to build – yet.

2. Talk to Potential Users

Not your friends. Not your family. Real users who experience the problem regularly. Have open-ended conversations, ask questions like:

- “What’s the most frustrating part of dealing with this issue?”

- “Have you tried solving it before? What worked, what didn’t?”

You’re not pitching; you’re learning.

3. Build a Low-Fidelity Prototype or Landing Page

Use free tools like Figma, Canva, or Notion to mock up your app’s core features. Or spin up a simple landing page explaining your concept.

Add a call to action like: “Sign up for early access” or “Join the beta.” The number of people who engage will give you early signals of interest.

4. Test Demand With Ads or Social Proof

Run low-budget ads on Google, LinkedIn, or Instagram targeting your core users. Track click-throughs, sign-ups, and time spent on your page.

You can also post in online communities like Reddit, Product Hunt, or Indie Hackers to gauge feedback and spark conversation.

5. Study the Competitive Landscape

You’re not alone in the space – and that’s a good thing. A lack of competition often signals a lack of demand. Analyze what others are doing, read app store reviews, and find gaps you can exploit or improve.

Remember: The goal here isn’t perfection. It’s progress.

You’re not just validating your idea – you’re validating that someone will pay to solve the problem.

Only once you’ve crossed this hurdle of the mobile app startup process should you start thinking about designs, tech stacks, and MVPs.

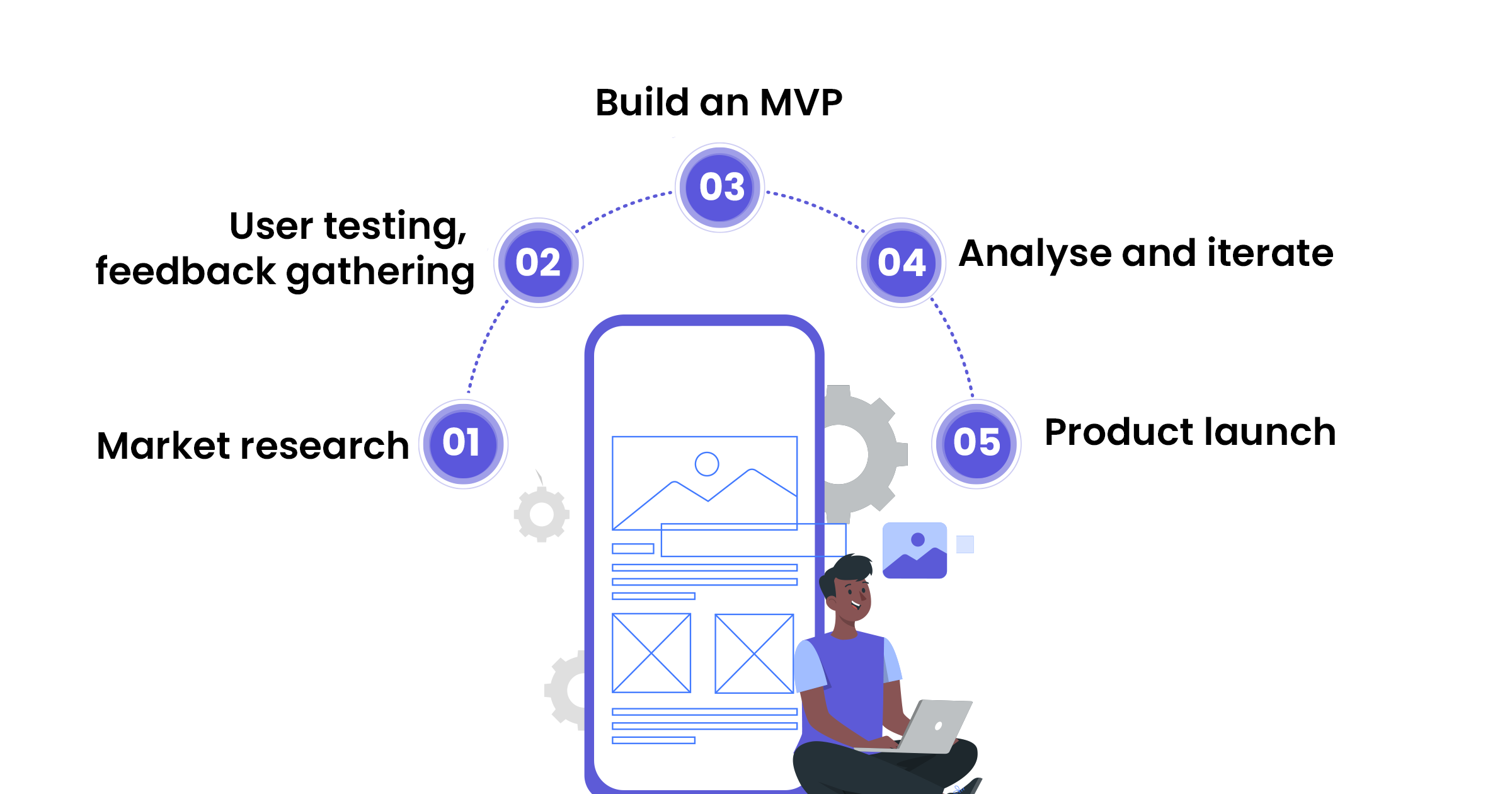

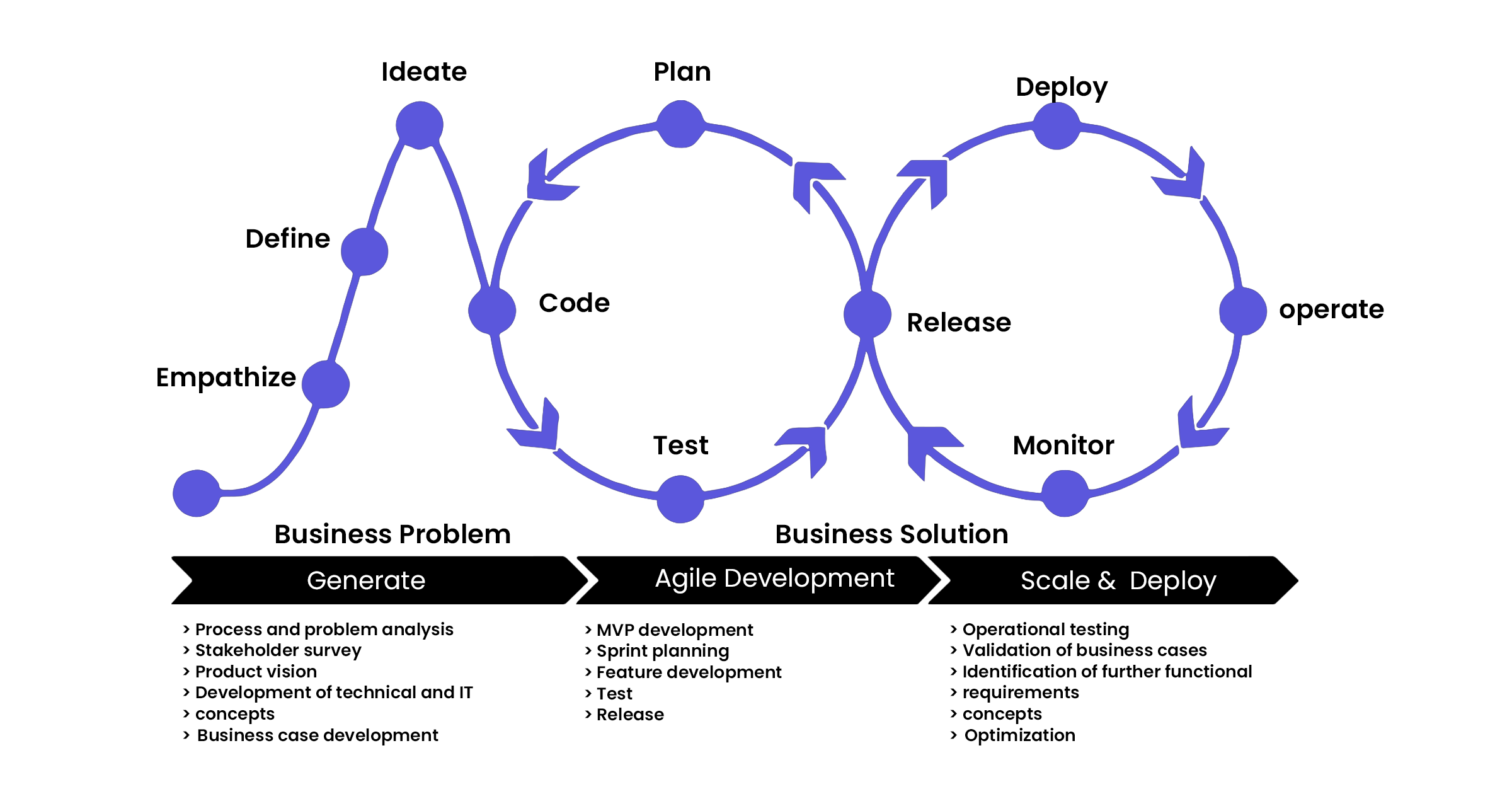

You’ve validated the idea – people want it, they’ve shown interest, and you’ve done your groundwork. Now it’s time to actually start building, but intelligently – without overcommitting time, money, or tech.

Building Your MVP – The First Real Milestone

Alright. You’ve validated the problem, talked to real users, and you know there’s demand. Now comes the first serious leap: how to scale your app business to IPO by turning your idea into something people can use.

But here’s where many founders make a critical mistake – they try to build the full app upfront. Every feature they’ve dreamed up. Every setting. Every design flourish.

Don’t.

What you need as one of the first steps to build a successful app is an MVP – a Minimum Viable Product. But let’s clear something up:

MVP doesn’t mean half-baked. It means laser-focused. It’s the simplest version of your product that delivers real value to users and helps you learn something concrete about your market.

So… What Should Your MVP Actually Include?

Ask yourself:

- What is the one key job my app is supposed to do?

- What’s the minimum set of features needed to deliver that?

- What can I cut without killing the core experience?

If you’re building a job-matching app, maybe the MVP just lets people create a profile and apply with one click. No messaging, no filters, no resume builders.

If it’s a fitness tracker, maybe it should just let users log workouts and see progress.

Focus on utility. Not bells and whistles.

Speed Matters – But So Does Quality

Your MVP doesn’t have to be pixel-perfect. But it needs to be usable, reliable, and valuable. Users should walk away thinking: “That solved my problem, even if it was basic.”

Some founders use no-code tools like Glide, Bubble, or FlutterFlow to ship faster. Others go with lightweight codebases using React Native or Flutter. If you’re non-technical, a freelance dev or a small product studio can help bring your MVP to life without blowing your budget.

The goal isn’t perfection – it’s momentum.

Set Clear MVP Goals

Don’t just “build and launch.” Know what you’re measuring:

- Do users complete the core action (e.g., booking a session, posting a listing)?

- Do they come back the next day/week?

- Are they referring others?

The data from your MVP will drive your next decisions: what to improve, what to kill, and what’s worth investing in long-term.

Remember: This Isn’t the Final Product

Your MVP is your learning tool. It’s there to:

- Confirm product-market fit

- Reveal unexpected user behavior

- Identify your power users

- Help you raise funds or attract co-founders

So treat it like a launchpad, not a legacy.

Bottom line: An MVP isn’t your dream app – it’s the stepping stone to it.

The goal isn’t to impress everyone. It’s to serve someone, solve something, and learn fast.

Finding Product-Market Fit – The Moment it Starts to Click

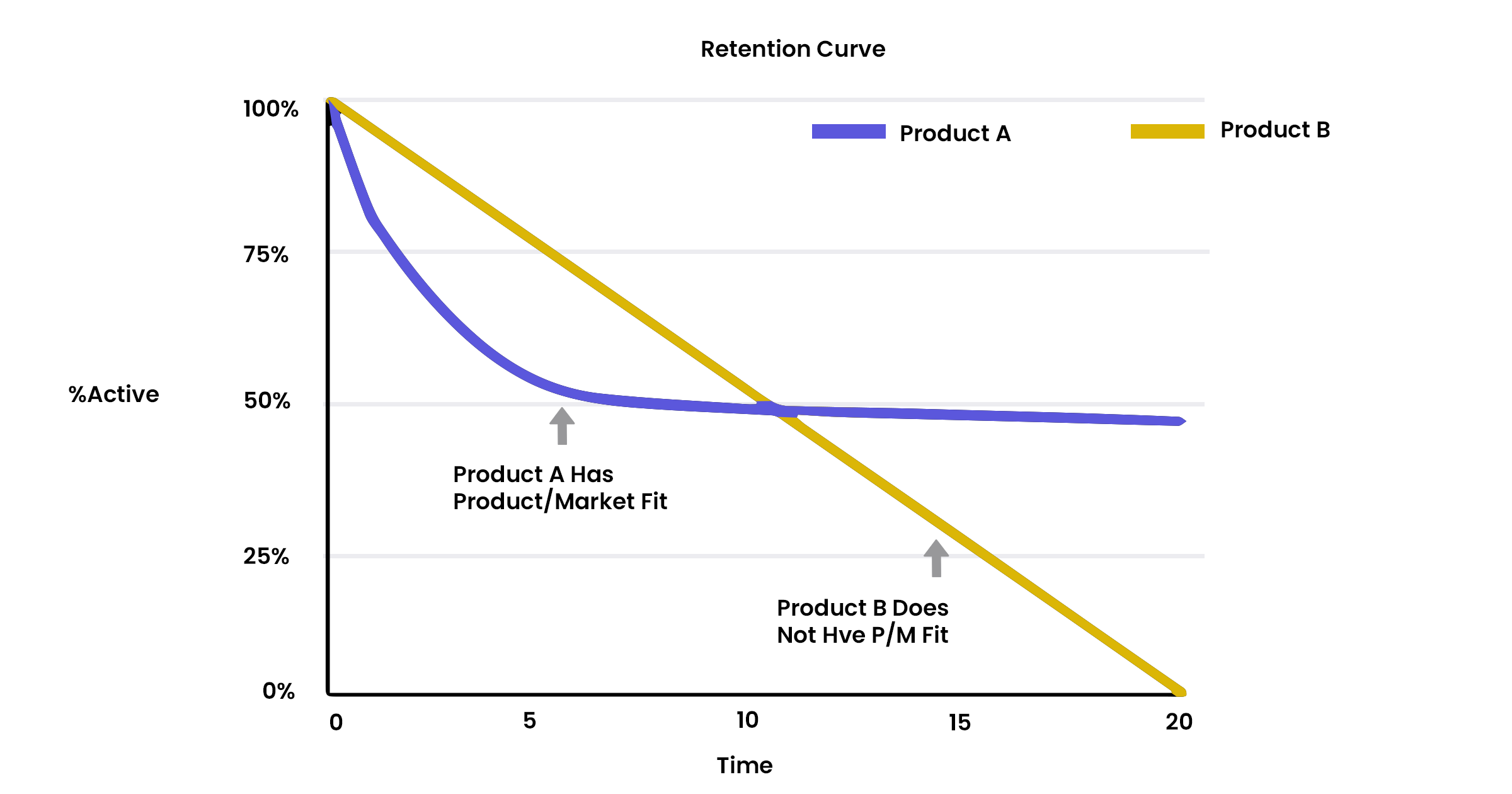

You’ve launched your MVP. You’re getting some feedback. A few users are poking around. Some drop off. Some stick.

Now comes the million-dollar moment every founder chases in their journey of app launch to IPO – Product-Market Fit (PMF).

It’s that elusive point where your product resonates so deeply with users that it almost feels like it’s growing on its own. Suddenly, users aren’t just using the app… they’re relying on it.

But let’s be clear:

PMF isn’t a single moment. It’s a slow, messy, often painful process of adjustment, listening, and iteration.

How Do You Know You’re Close?

You’ll start noticing things like:

- Users are coming back – without email reminders or push nudges.

- People are telling their friends. Unprompted.

- You’re seeing signs of obsession – users hack around missing features just to keep using the product.

- Churn is shrinking. Retention is climbing.

- Feedback shifts from “this is interesting” to “please don’t change this, I need it.”

You may also start hearing one magical phrase in conversations:

“I’ve been looking for something like this.”

What If You Don’t Feel It?

That’s completely normal.

Most apps don’t hit product-market fit right out of MVP in their app startup roadmap. That’s the whole point – you launched early so you could listen and learn.

What to do:

- Double down on talking to users. Not in a survey. In real conversations.

- Track what your most active users are doing. Where do they spend time? What’s driving retention?

- Cut the noise. If a feature doesn’t drive stickiness, strip it out and focus on what does.

- Ship fast, but with purpose. Every update should be in service of solving the user’s core pain, not just “adding cool stuff.”

Metrics That (Actually) Matter

Forget vanity metrics. At this stage, obsess over:

- Activation rate: How many users reach the ‘aha moment’ within their first session?

- Retention rate: Are users coming back after 1 day, 7 days, 30 days?

- Net Promoter Score (NPS): Would they recommend your app? And why or why not?

- DAUs/WAUs: Not just active users, but consistently engaged ones.

If these numbers are stagnant, that’s not failure – it’s feedback. Dig into the why.

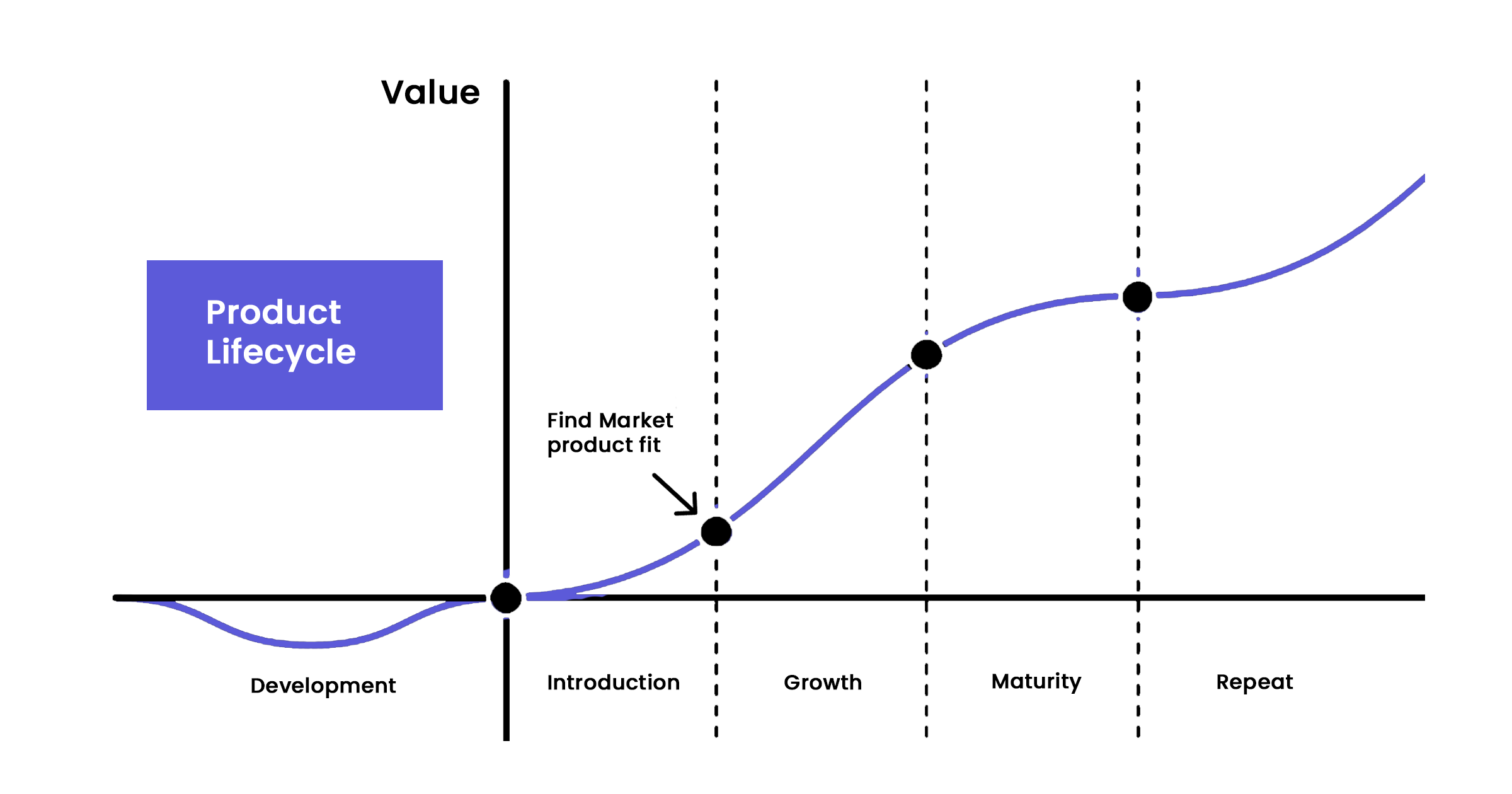

What Happens After You Hit PMF?

Don’t rush to scale just yet.

Once you feel the pull – real demand, user love, maybe even early revenue – it’s time to tighten up operations, prep your roadmap, and build a repeatable, scalable growth engine.

This is the point where investors start to take notice. But more importantly, it’s when you start to believe:

“This could be bigger than I thought.”

Here’s the hard truth: Product-market fit doesn’t come from great ideas. It comes from uncomfortable honesty, fast iterations, and staying obsessed with the problem – not the product.

From Product-Market Fit to IPO – The Long Game Begins

You’ve made it further than most. You’ve built something real. People use it, love it, and even depend on it. Now comes the leap from startup to scaleup – and possibly, one day, to IPO.

But let’s get one thing straight:

Going public isn’t a finish line. It’s an evolution. An IPO isn’t just a funding event – it’s a signal to the world that your company has matured into a business that’s accountable, transparent, and built to last.

So what does it really take to get from Product-Market Fit to IPO? Here’s what most founders don’t hear enough about when scaling an app startup.

A. Building for Scale, Not Just Survival

At this stage, you need to stop thinking like a startup and start operating like a business. This means:

- Solidifying your revenue model. You’re no longer experimenting – you’re proving you can grow revenue quarter after quarter.

- Improving operational efficiency. Are your unit economics sustainable? Are you burning cash to grow, or is growth becoming more efficient over time?

- Expanding the team wisely. Founders can’t wear every hat anymore. You need senior leadership – finance, operations, legal, compliance – who’ve done this dance before.

B. Creating a Culture That Can Withstand Scrutiny

Public companies are dissected by the press, regulators, investors, and competitors. Before you go IPO, ask yourself:

- Is your cap table clean and well-managed?

- Are your financial statements audit-ready?

- Do you have documented internal processes, a working board, and scalable governance?

- Are you tracking key business metrics consistently and transparently?

Because when you’re public, every slip-up is public.

C. Understanding the IPO Timeline

Most companies don’t “apply” for an IPO in the same way you’d apply to an incubator or VC fund. It’s a multi-year journey. Here’s what typically needs to happen for mobile app growth strategy:

- Hire an investment bank (or multiple) to underwrite the IPO.

- Work with auditors and legal teams to prep your S-1 (the IPO filing with the SEC).

- Get your financials audited for at least 2–3 years prior.

- Conduct a roadshow where you pitch institutional investors.

- Finalize pricing, issue shares, and officially go public.

And this entire process? It can take 12–24 months – after you’re ready.

D. When Should You Consider Going Public?

IPO is not for every startup. Ask yourself:

- Have we reached ~$100M+ in annual revenue (for tech companies, this is often a benchmark)?

- Is our growth repeatable and predictable?

- Are we operationally and financially transparent enough to withstand investor scrutiny?

- Do we have a compelling market story to tell?

If the answer is “not yet,” that’s perfectly fine. Many companies stay private, raise late-stage funding, or even explore alternatives like SPACs or direct listings.

E. IPO Isn’t the Only Exit (But It Is the Most Public One)

Let’s not forget – IPO isn’t the only path forward. You could:

- Be acquired by a larger company (strategic exit)

- Merge with another startup or PE-backed business

- Continue operating profitably as a private company

But if you’re dreaming of ringing that bell on the NYSE or Nasdaq, know this:

It’s not just about money. It’s about trust, growth, and building something the world takes seriously.

TL;DR:

Product-Market Fit is just the beginning. IPO is a commitment – to shareholders, to the public, and to your vision.

If you’re ready for the spotlight, build for resilience, transparency, and long-term impact.

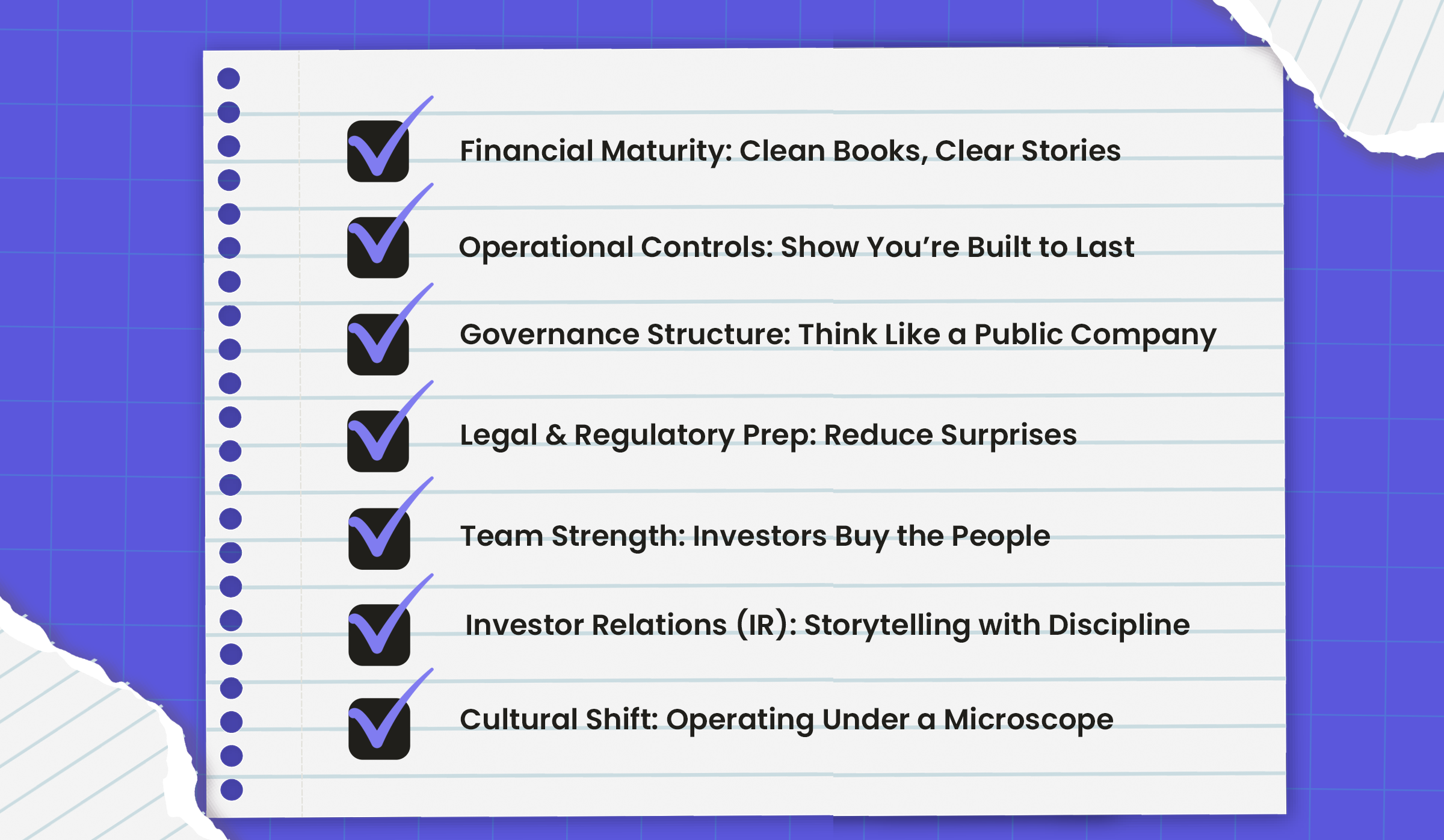

What Investors and Regulators Expect Before You Go Public

So, your product has market traction. Your revenue’s climbing. Maybe investors are nudging you to consider a public debut.

But getting listed on the stock market isn’t as simple as flipping a switch. It’s a massive operational, legal, and cultural transformation.

Here’s what truly matters if you want your app development to funding filing process to be taken seriously – and eventually be declared effective by the SEC.

A. Financial Maturity: Clean Books, Clear Stories

If there’s one non-negotiable for IPO readiness, it’s this:

Your numbers should be in order.

- 3 years of audited financial statements (2 years may suffice for “emerging growth companies” under the JOBS Act)

- GAAP-compliant reporting (not just what your startup accountant used in the early days)

- Well-documented revenue recognition, expense categorization, and cost of goods sold

- A rock-solid forecasting model that shows how the business scales

Any red flags in your accounting will definitely come up during SEC review – and could delay or derail the entire IPO timeline.

B. Operational Controls: Show You’re Built to Last

Startups often run on gut instinct and scrappy decision-making. That doesn’t fly when you’re public.

You’ll need:

- Internal controls over financial reporting (SOX compliance if you’re a U.S. issuer)

- Clear org structures, responsibilities, and approval workflows

- Scalable systems (CRM, ERP, HRIS) that auditors and investors trust

Start upgrading early. Investors want to know you’re not just a product – they’re buying into a business.

C. Governance Structure: Think Like a Public Company

No one’s expecting your board to look like Apple’s overnight. But to go public, you must show good governance.

That means:

- A diverse, independent board of directors (with audit, comp, and nominating committees)

- A CEO who doesn’t control everything

- Clearly defined policies on ethics, disclosures, conflicts of interest, and compensation

When investors see mature governance, they trust your long-term strategy – not just your short-term numbers.

D. Legal & Regulatory Prep: Reduce Surprises

Before the SEC signs off on your S-1 filing, they’ll be combing through your cap table, contracts, IP, and past legal activity.

Do this ahead of time:

- Clean up the cap table. Fix inconsistencies, undocumented stock promises, or messy SAFE rounds.

- Lock down IP. Ensure your patents, trademarks, and source code are owned by the company – not freelancers or ex-founders.

- Disclose material risks. Be honest. It’s better to list risks upfront than to be hit with lawsuits after listing.

Hire legal counsel experienced with IPOs – not just general startup law.

E. Team Strength: Investors Buy the People

Yes, your finances matter. But so does your bench.

Institutional investors will be asking:

- Is the CEO coachable, communicative, and visionary?

- Is there a CFO with public market experience?

- Does your team have leaders who’ve scaled before?

- Can the culture handle scrutiny, pressure, and quarterly targets?

Bringing on experienced operators – even as advisors or interim execs – can raise your IPO readiness score significantly.

F. Investor Relations (IR): Storytelling with Discipline

Public companies live and die by how they communicate their vision.

Start practicing now:

- Can you clearly articulate your mission, moat, and market opportunity?

- Are your earnings reports and forecasts based on reality, not hope?

- Do you have a spokesperson (often the CEO) who can earn Wall Street’s confidence?

Consider hiring a Head of IR early to prep messaging, roadshow decks, and press narratives.

G. Cultural Shift: Operating Under a Microscope

Last but not least, prepare for life in the public eye.

That means:

- Every decision you make could move your stock price

- Media scrutiny will ramp up

- Employee expectations shift – especially around stock value and performance reviews

- You’ll be reporting quarterly – like clockwork

Build internal alignment early. A culture that thrives on transparency and discipline won’t crack under IPO pressure.

TL;DR: IPO Readiness Checklist

Before filing, ask yourself:

- Are our financials audit-ready?

- Are we SOX-compliant or on track?

- Is our board structured correctly?

- Is our cap table clean and clear?

- Is our IP secure and properly assigned?

- Do we have public-market-grade leadership?

- Are we ready for life as a public company?

If most of those answers are yes – you’re getting close.

How CodingworkX Helps Founders Build IPO-Ready Products

Going public doesn’t start with an S-1 filing – it starts with building a product that scales, adapts, and earns user trust. That’s where CodingworkX steps in.

As a product-driven software development company, we work with founders from the very beginning – transforming bold ideas into solid, scalable apps designed for growth. But we don’t stop at code.

Here’s how we have cracked the answer to how to take an app idea to IPO :

- MVP with a Market Edge: We help you build a lean, user-centric MVP that’s not just functional, but marketable – fast.

- Scale-Ready Architecture: From day one, our development teams build with scale in mind. So when your user base explodes, your app won’t break.

- Custom Tech for Unique Business Models: We don’t believe in templates. Every line of code we write is tailored to your product vision, industry nuances, and long-term monetization plan.

- Analytics & Insights Built-In: We bake in tools for data-driven decision-making, so you always know what’s working and what needs to pivot.

- Compliance and Security: We help implement the technical side of compliance – from data privacy (GDPR, HIPAA) to audit trails that make life easier during IPO due diligence.

- Support Beyond Launch: Whether you’re iterating post-MVP, integrating AI, or prepping your backend for IPO-level scrutiny, we scale with you.

At CodingworkX, we’re not just developers – we’re startup allies, product thinkers, and long-term partners for founders who are building with ambition.

FAQs.

Q. What are the key stages in an app’s journey from idea to IPO?

Ans. An app typically progresses through several stages: idea validation, market research, MVP development, early traction, securing product-market fit, scaling the product and team, raising investment rounds (Seed to Series C+), and finally, preparing for IPO through financial audits, legal structuring, and public market readiness. Each phase demands different strategies, resources, and execution styles.

Q. How do you validate an app idea before development?

Ans. Validation begins by identifying a real user pain point. Conduct user interviews, run surveys, and assess competitors to confirm demand. You can also use landing pages, prototypes, or waitlists to test interest. The goal is to prove there’s a paying audience for your solution before investing in full development.

Q. What steps are involved in launching a mobile app startup?

Ans. Launching involves identifying your niche, building an MVP, choosing a development approach (native, hybrid, or no-code), setting up analytics, and launching on app stores. You’ll also need to plan your go-to-market strategy, gather early feedback, refine the UX, and actively market to your target users from day one.

Q. What role does MVP play in an app’s success journey?

Ans. The MVP is your test bed. It helps you release a usable version of your product with just the core features, allowing real users to interact with it. This phase helps validate assumptions, uncover user behavior, and decide whether to scale, pivot, or pause. A well-built MVP reduces risk and speeds up product-market fit.

Q. How long does it take to go from app launch to IPO?

Ans. On average, startups that reach IPO do so within 7–10 years. However, timelines vary depending on market demand, funding access, execution speed, and regulatory compliance. Some unicorns scale quickly due to timing and traction, while others take a more measured path toward sustainable growth before going public.

Q. Why do some apps fail before reaching the IPO stage?

Ans. Apps may fail due to lack of product-market fit, poor retention, unsustainable monetization models, or premature scaling. Others falter from weak leadership, internal misalignment, or external factors like market shifts. Reaching IPO isn’t just about having a great app, it’s about long-term execution, adaptability, and business fundamentals.